We are now days away from Bitcoin’s halving, which occurs every 4 years and is one of the critical elements for the security of the network. While many analysts and investors continue to talk about the impact of halving on the Bitcoin price, an important and detailed report came from Bitwise company.

In the 8-page report of the crypto investment management company, which also has a Bitcoin spot ETF product, both the short and long-term effects of the reward halving on the Bitcoin price and its reflections on mining companies were analyzed.

“Halfings are great for Bitcoin”

The following statements were used in the analysis, which stated that the reward halving definitely had a positive impact on the Bitcoin price:

“We do not have much data on the short-term impact of reward halvings on the price, other than 3 halvings. Therefore, we can make some intuitive comments in the short term. But long-term numbers show that halvings are great for the Bitcoin price. Bitcoin price one year after halving;

2012’%8839

2016 and %285

It increased by 6% in 2020.

Since the market prices short-term effects, we can also say that long-term effects are actually underestimated by investors. Similarly, Bitcoin spot trading volumes decreased by an average of 27.78% in the first month after the halving, but grew significantly the following year, increasing by an average of 6,580.69%.”

Don’t pass without reading! | What is 5 thousand percent Rising OMNI Coin?

“Good for miners too”

The following statements were used in the report, which stated that miners, who obtained a large portion of their income from the Bitcoin reward system, also made significant gains in the year after the halving:

“Miners earn most of their income in Bitcoin through the transactions they verify. Therefore, halving these rewards may lead to the idea that the halving is bad for miners. However, looking at the data, it is seen that miner revenues increased by an average of 1458% in the year after the halving. There is a 46% decrease in the month after the halving…”

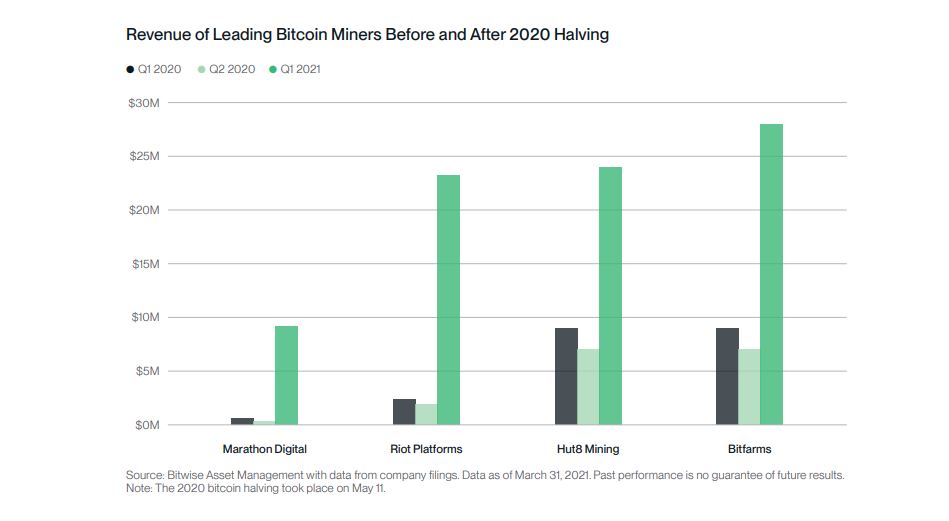

What did major miners experience during the 2020 halving?

The report also touched upon the last halving in 2020 and focused on the figures of major mining companies during this period:

“The halving in 2020 was actually the first halving experienced by companies listed on the stock exchange in the USA. It is obvious that the revenues of Marathon Digital, Riot Platforms, Hut 8 and Bitfarms companies decreased in the quarter after the halving (46% on average), but the increase in the price of Bitcoin, the companies starting to use more efficient machines and adapting to the network significantly increase their revenues in the following periods. “The companies’ share prices also showed a strong performance in the year after the halving.”

It was published:

Last update:

Source: https://uzmancoin.com/bitcoin-halving-bitwise-fiyat-madencilik/