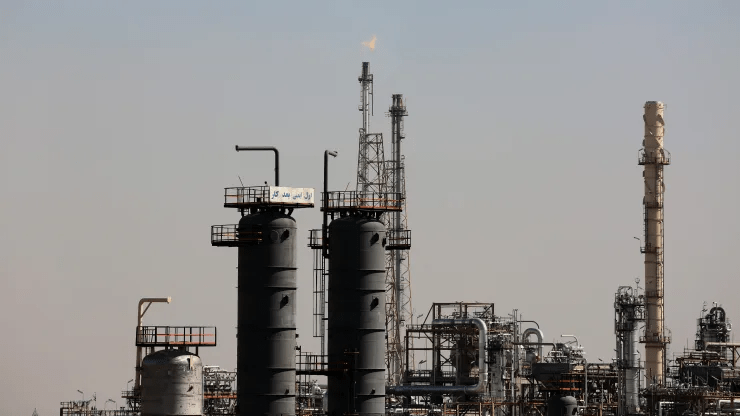

The outbreak of a major conflict in the Middle East could trigger an energy crisis that would push oil prices above $100 a barrel, stoke inflation and translate into higher interest rates for longer, the U.S. government warned Thursday. World Bank.

Tensions in the Middle East reached a boiling point earlier this month when Israel and OPEC member Iran appeared on the brink of war, raising fears that crude oil supplies could be disrupted as a result.

The governments of Jerusalem and Tehran appear to have decided not to aggravate the situation after exchanging direct attacks on each other’s territory for the first time. Oil prices have retreated nearly 4% from their recent highs as investors have discounted the likelihood of a broader war in the region.

However, the World Bank warned that the situation remains uncertain.

Escalation of conflicts in the Middle East region: restrictions on commercial flights

“The world is at a vulnerable moment: A major energy crisis could undermine much of the progress made in reducing inflation over the past two years,” said Indermit Gill, Chief Economist at the World Bank.

Oil prices could average $102 per barrel if a conflict involving one or several Middle Eastern oil producers causes a supply disruption of 3 million barrels a day, according to the latest World Bank report. on the outlook for raw materials markets. A price shock of this magnitude could almost completely paralyze the fight against inflation, according to the report.

According to the World Bank, global inflation fell by 2% between 2022 and 2023, largely due to the drop in commodity prices by almost 40%. Now, commodity prices are stabilizing, with the global financial institution forecasting modest declines of 3% this year and 4% in 2025.

Oil prices have retreated nearly 4% from their recent highs as investors have discounted the likelihood of a broader war in the region.

“Global inflation remains undefeated,” Gill said. “A key force for disinflation – falling commodity prices – has essentially hit a wall. That means interest rates could remain higher than expected this year and next.”

Although the conflict in the Middle East presents upside risks to prices, the world could see relief if OPEC+ decides to start undoing its production cuts this year. Oil prices would fall to an average of $81 a barrel if the cartel puts 1 million barrels a day back on the market in the second half of the year, according to the World Bank.

Source: https://reporteasia.com/destacado/2024/05/01/banco-mundial-advierte-escalada-precio-petroleo-oriente-medio-podria-disparar-inflacion/