Krypto para analysis firm Alphractal, Bitcoin reported that miners are experiencing the first capitulation of 2024 and that more potential challenges lie ahead.

The company’s analysis, based on Hash Ribbons, Difficulty Ribbons, and its proprietary capitulation identifier, highlights two types of miner capitulation: Moderate and Aggressive.

Moderate Capitulation

Moderate Capitulation can occur when some miners scale back or close their operations, usually following a strategic Bitcoin sale or adjustments to their business models. This type of capitulation is typically triggered by falling profits or operational inefficiencies but is not as severe as Aggressive Capitulation.

Aggressive Capitulation

Aggressive Capitulation is a more extreme event and is a rare occurrence usually marked by a significant number of miners ceasing their operations due to sharp declines in the price of Bitcoin or sudden external shocks. One notable example was the 2021 mining ban in China, which forced many miners to abruptly halt their operations. Historically, Aggressive Capitulation coincides with Bitcoin price bottoms and occurs after periods of high miner revenue during bull markets, such as in 2011, 2018, and 2021.

According to Alphractal, Aggressive Capitulation is typically triggered by a large disparity between the Bitcoin network’s hash rate and difficulty adjustment, and this process takes approximately 14 days. This short window is often crucial, as capitulation events generally last no more than two weeks.

How is the 2024 Bitcoin Miner Capitulation According to the Analysis Company’s Claim?

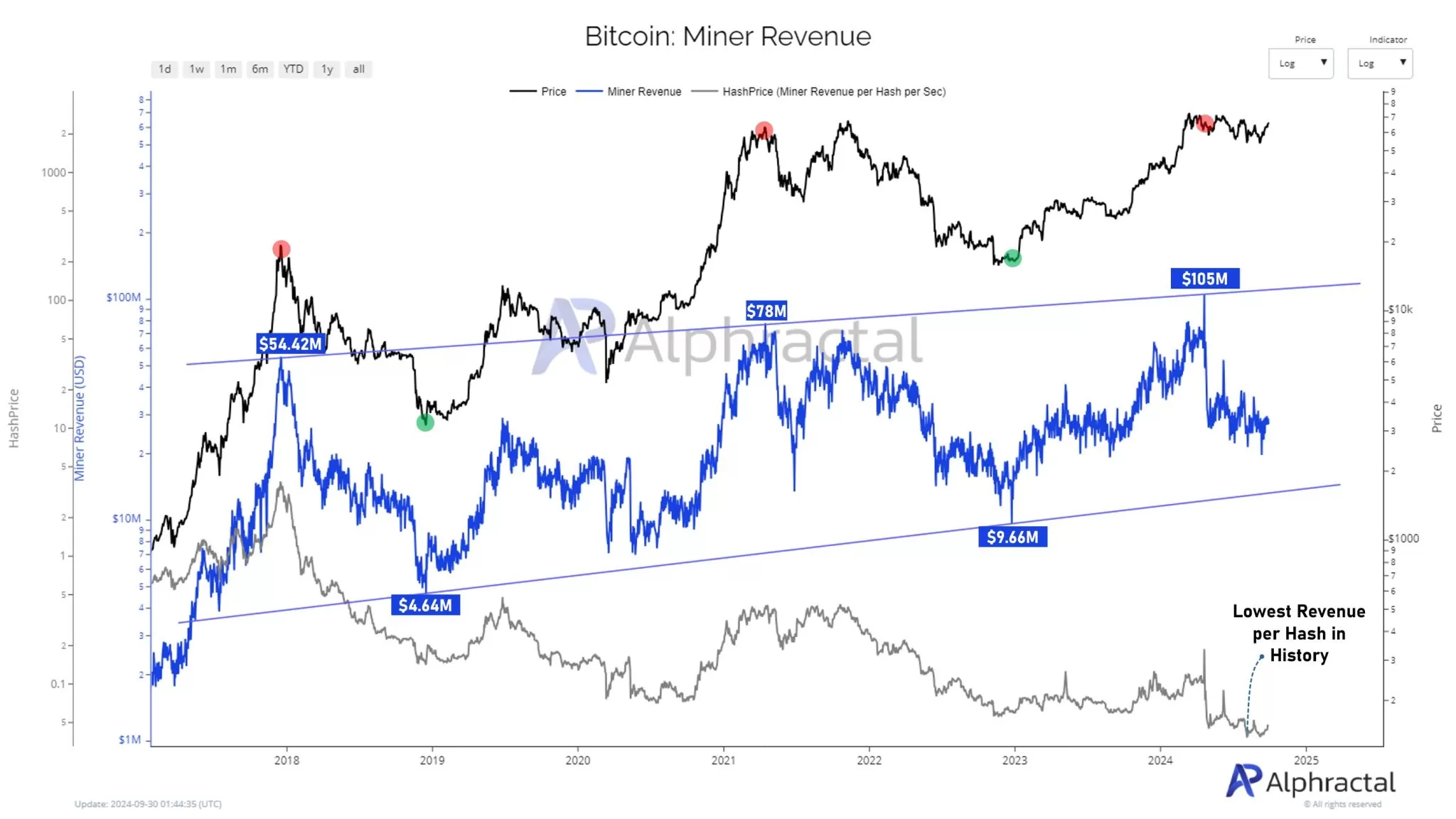

In June 2024, Bitcoin miners experienced a moderate capitulation event, with daily revenue per hash dropping to a historical low. This has led many miners to re-evaluate their operational strategies. While total mining revenue in US dollars peaked at $105 million this year, post-hash revenue has not returned as it has in previous cycles, indicating a shift in market dynamics.

One of the most significant changes noted by Alphractal is the increasing presence of large mining companies, which changes the underlying metrics on the chain. The performance of these companies’ stocks is now more closely linked to on-chain data, reflecting a more centralized and competitive environment. This centralization introduces new risks as smaller miners struggle to compete with larger companies that can invest in new equipment and optimize their operations.

Alphractal warns that if a major mining company were to shut down, it could lead to a sharp drop in the hash rate of the Bitcoin network, potentially triggering a new round of miner capitulations. With these risks on the horizon, the future of Bitcoin mining in 2024 looks more uncertain compared to previous cycles.

*This is not investment advice.

For exclusive news, analysis and on-chain data Telegram our group, Twitter our account and Youtube Follow our channel now! Moreover Android ve IOS Start live price monitoring now by downloading our applications!

Source: https://www.bitcoinsistemi.com/analiz-sirketi-kritik-uyari-paylasti-bitcoin-madencileri-icin-riskli-gorunum-var-anlami-ne/