Disclaimer: This content is a sponsored article. Bitcoinsistemi.com is not responsible for any damages or negativities that may arise from the information in this article or any product or service mentioned in the article. Bitcoinsistemi.com advises readers to do individual research about the company mentioned in the article and reminds them that all responsibility belongs to the individual.

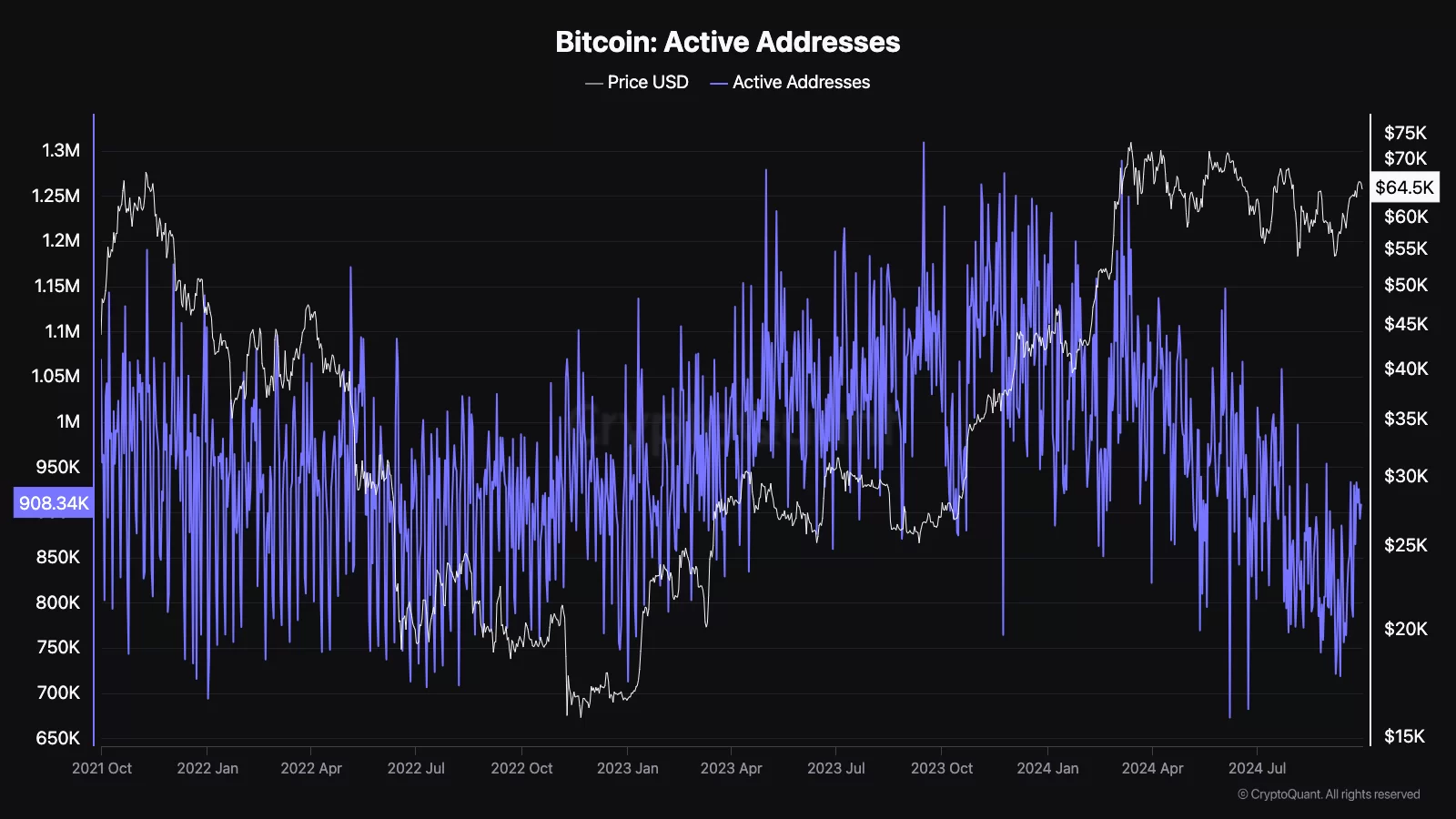

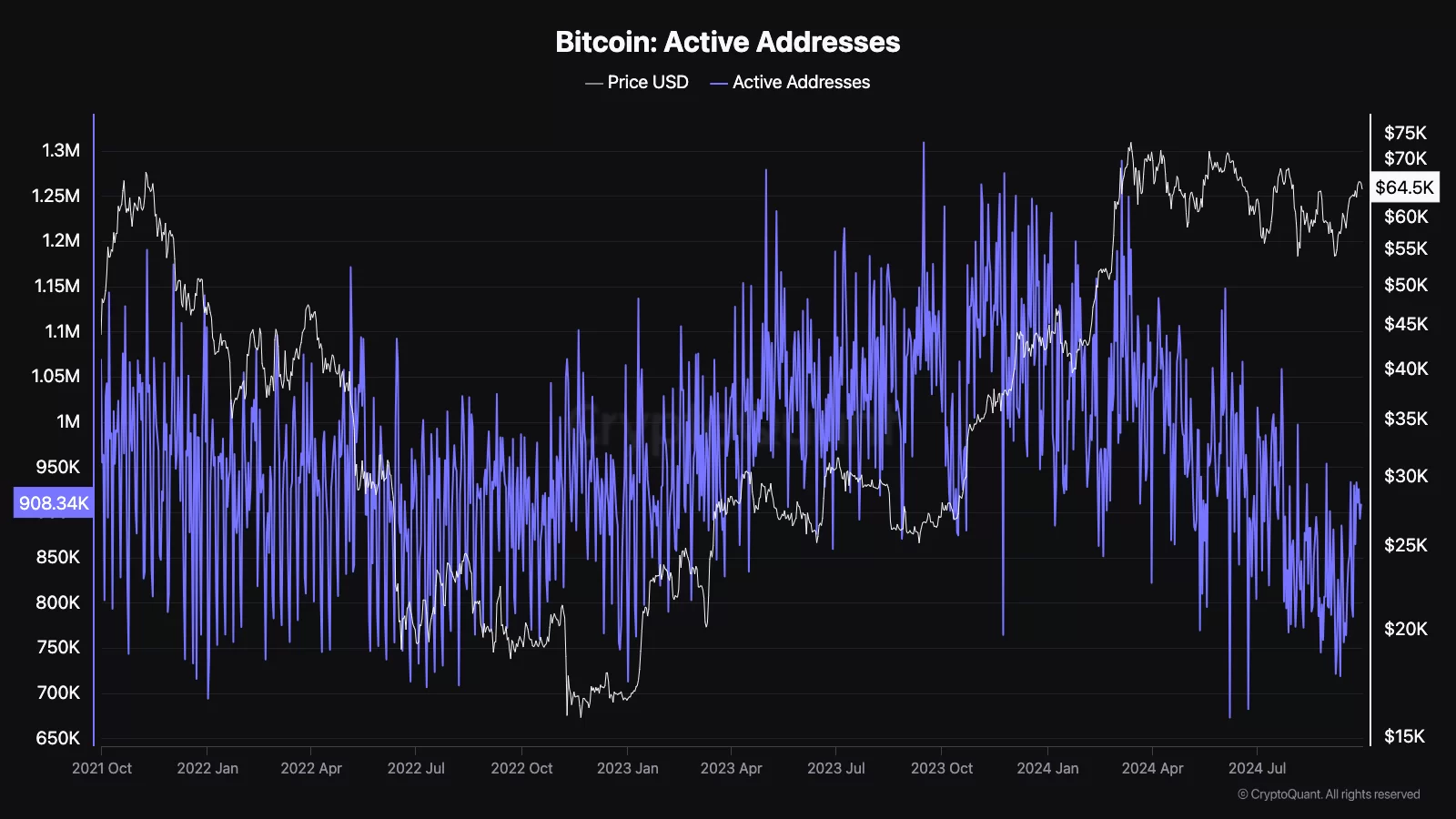

The crypto market never remains static and this time Bitcoin is in the headlines again. With US Bitcoin ETFs purchasing $1.1 billion worth of BTC, it is clear that the Bitcoin Dollar (BTC USD) ratio has changed. Well this is BTC price and what does it mean for the broader crypto market?

In this article, we will take a closer look at how this massive ETF purchase is affecting Bitcoin’s trajectory and what it could mean for the future. Is it time to follow Bitcoin more closely?

US Bitcoin ETFs: Big Buy and Its Impact on Bitcoin Dollar (BTC USD)

Between September 23-27, Bitcoin ETFs in the US purchased over $1.1 billion worth of Bitcoin. This is the largest amount since mid-July. ETFs led by BlackRock, ARK 21Shares, and Fidelity had the largest inflows of $499 million, $289.5 million, and $206.1 million, respectively.

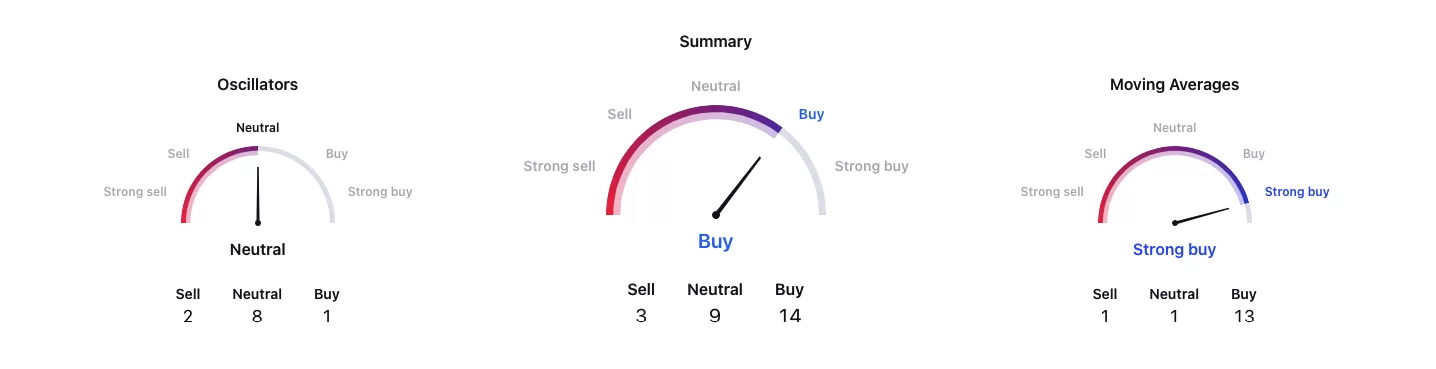

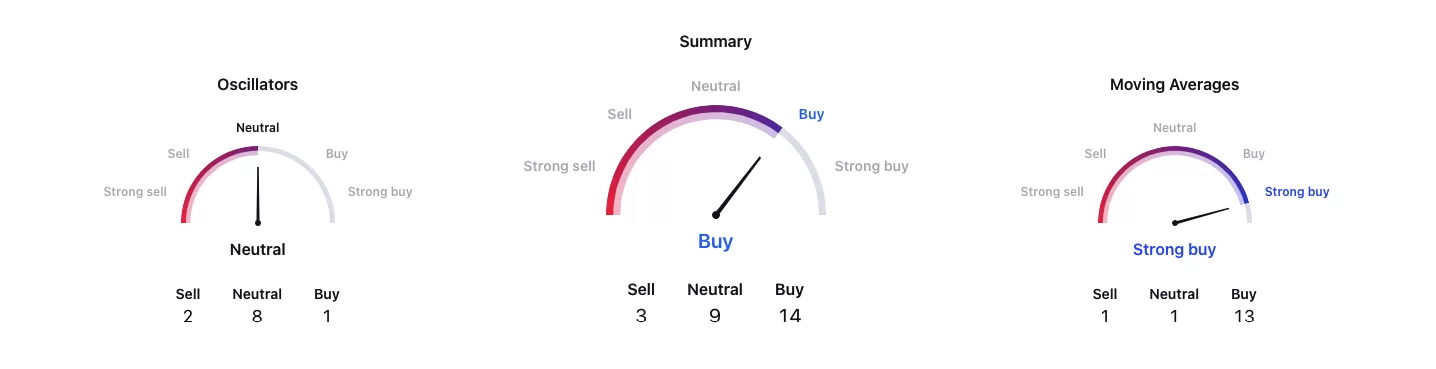

This purchase follows the Federal Reserve’s decision to cut interest rates on September 18 and BTC USD increased confidence in the market. Following the interest rate cut, Bitcoin price increased by 13.8% to $65,800.

As Bitcoin rises, investors also follow the Bitcoin Euro market. With increasing demand and changes in both the USD and Euro, Bitcoin’s trajectory could change over the next few weeks, especially as global markets react to these massive ETF purchases.

These inflows reflect people’s growing belief in Bitcoin as a hedge against inflation. As more people buy Bitcoin shares, crypto- We see that the money market is strengthening and the BTC price USD is also rising.

How Does the $1.1 Billion Purchase Affect the Dollar and Bitcoin Market?

This is 1.1 billion dollar purchase, many people Bitcoin price It made one wonder what’s next for the USD. Currently, the Bitcoin dollar is 10.8% below its all-time high of $73,738 on March 14.

The growing interest in BTC to USD is due in part to increased confidence in Bitcoin as a solid portfolio choice. Many experts Bitcoin price today He believes it could soon surpass previous records, which could lead to greater attendance.

In addition to these developments in Bitcoin, other developments such as Ethereum cryptocurrencies also attracts attention. Ether-based ETFs saw inflows of $85 million this week, the highest since August.

Minotaurus ($MTAUR): A Promising Addition for BTC Holders

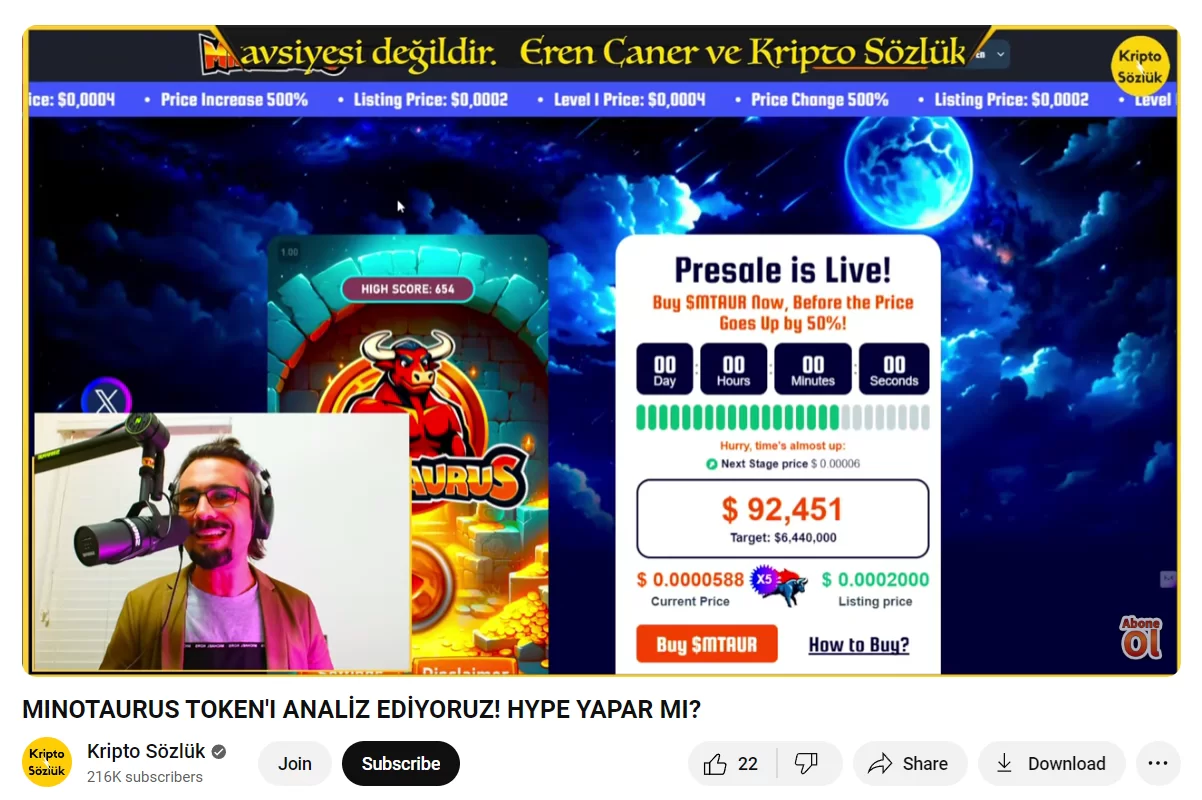

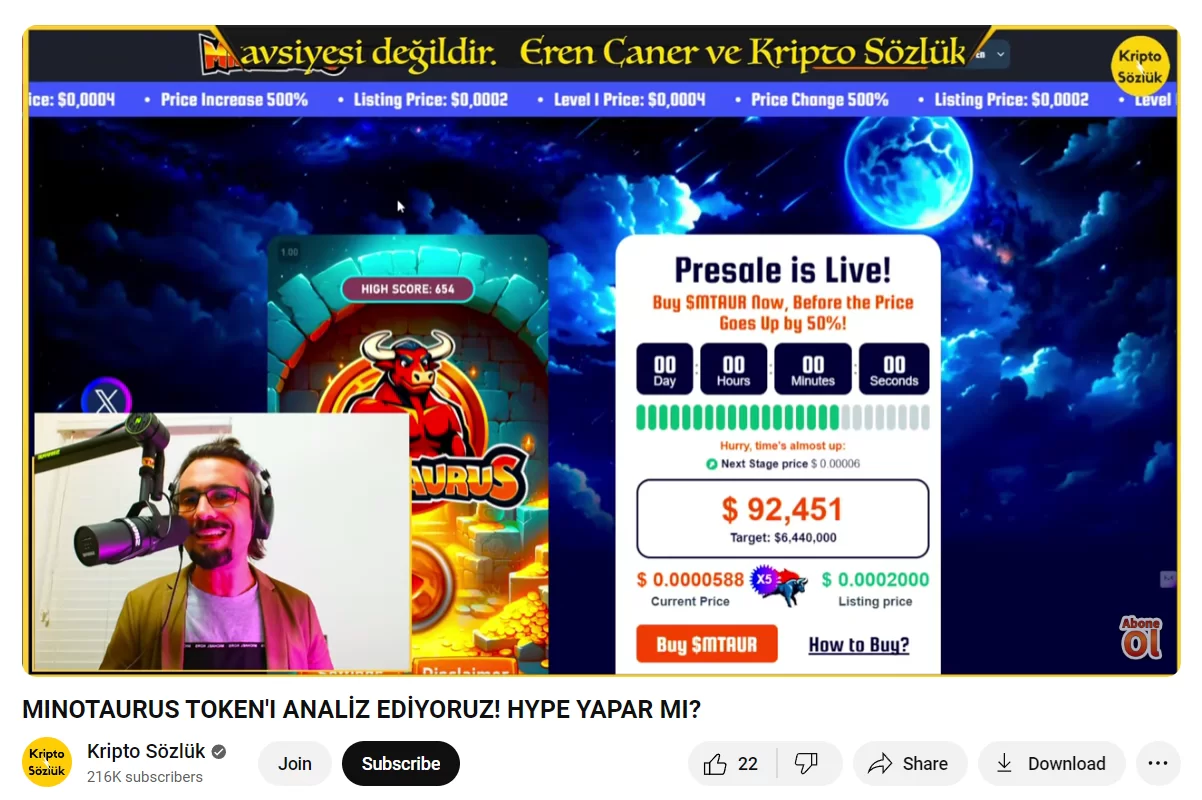

The sentiment around Bitcoin seems positive and many are eagerly anticipating a rise. But remember that the market can change instantly. To protect against sudden changes, savvy investors can look for options with a more stable growth path. One such choice favored by BTC investors is the Minotaurus ($MTAUR) presale.

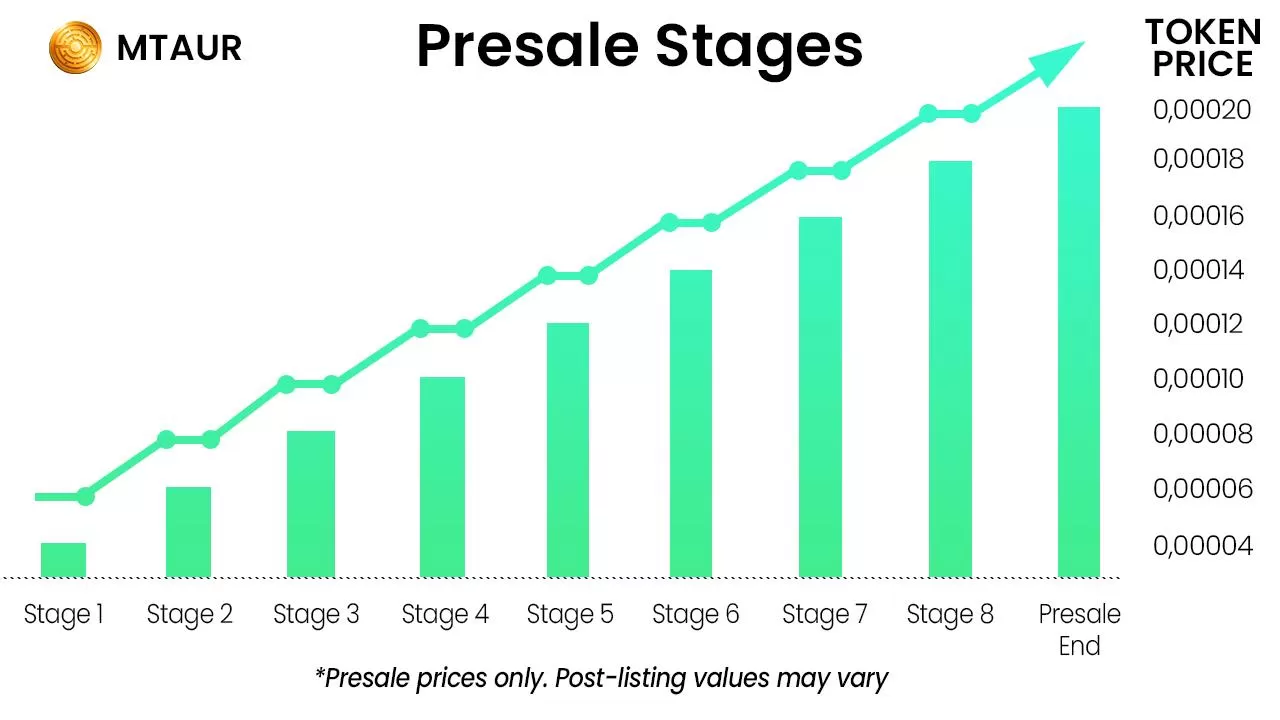

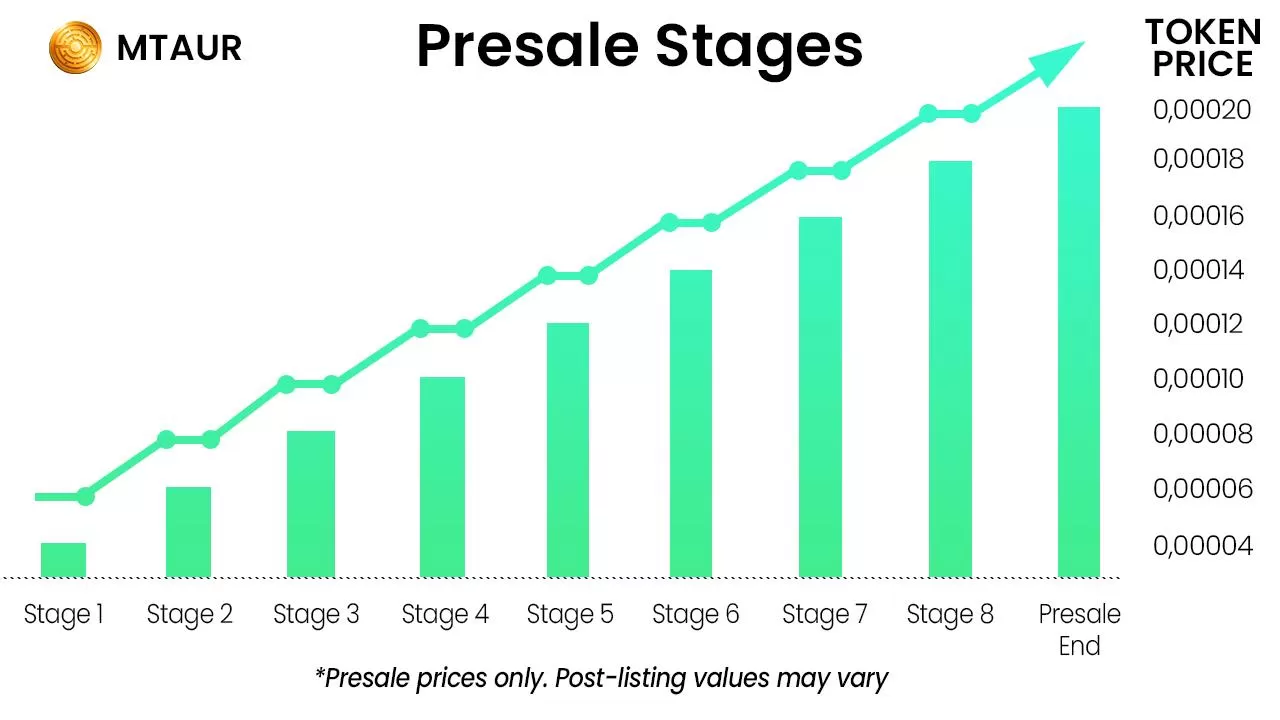

Currently priced at just $0.00005959, you’re looking at a whopping 70% off the listing price of $0.00020. If you join today, you can enjoy a potential increase of approximately 236%. For those who have been with Minotaurus ($MTAUR) from the beginning, the increase is around 50%, and overall pre-sales growth can reach 400%.

$MTAUR has a powerful role in the Minotaurus game, allowing players to unlock exciting features such as equipment, power-ups, and special zones. With the casual gaming industry valued at approximately $15 billion and expanding at approximately 9% annually, $MTAUR is perfectly positioned for growth. Crypto fans and thought leaders have already appreciated the potential of this project.

Additionally, there are great benefits for owners like referral bonuses for referring friends and a qualifying program that offers extra incentives. The smart contract has been audited by SolidProof and Coinsult and ensures its security. With all these advantages, it makes sense to secure $MTAUR in the presale. The low-priced token pool is running out fast — Join the Minotaurus community while you can!

Solution

With $1.1 billion inflows into Bitcoin ETFs, the price may continue to rise. Institutional interest in Bitcoin and the crypto market is growing rapidly.

Bitcoin USDAs the demand for BTC USD increases, it is important to monitor the relationship between BTC USD and institutional players. The Bitcoin dollar market is gaining strength and it is worth considering how high the Bitcoin price can go. Could Bitcoin reach new highs soon? We’ll have to wait and see.

Learn more about Minotaurus:

Website: http://minotaurus.io/

Announcements: https://t.me/minotaurus_official

Chat: https://t.me/minotaurus_chat

Twitter: https://twitter.com/minotaurus_io

Source: https://www.bitcoinsistemi.com/abd-bitcoin-etfleri-11-milyar-dolarlik-btc-satin-aldi-bitcoin-dolari-btc-usd-ve-mtaura-yonelik-artan-talep/