Kris Marszalek, CEO of Cryptocom exchange, participated in the broadcast of Bloomberg from the...

China’s Ministry of Public Security has initiated a targeted campaign to combat criminal activities...

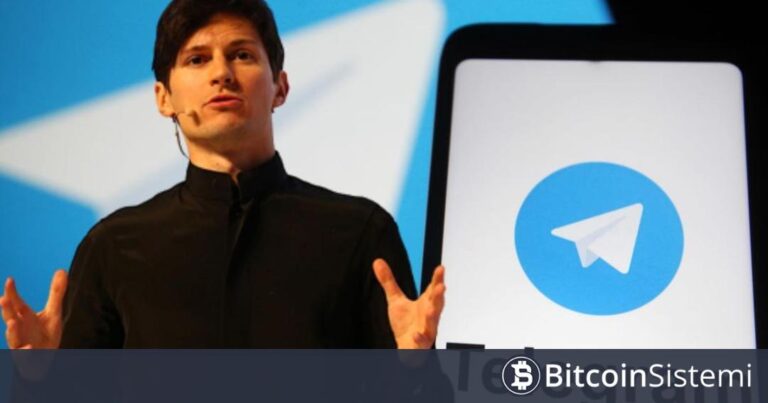

Popular messaging app Pavel Durov, founder of Telegram He made statements about the cryptocurrency...

Recommended for you Source: https://reporteasia.com/imagen-del-dia/2024/04/19/comenzo-la-cuenta-regresiva-para-los-juegos-olimpicos-de-paris-2024/

long awaited Bitcoin While there are a few days left for the halving, it...

Binance exchange announced its new platform called Megadrop in its statement. The first coin...

Learn how to make the roller coaster cookie that went...

Beijing’s Forbidden City meets the Palace of Versailles on a cross-cultural journey To commemorate...

Coinbase, the largest cryptocurrency exchange in the USA Omni Network (OMNI) He announced that...

Undoubtedly, among the topics discussed in recent days Bitcoin ve in altcoins The declines...

Learn how to make plantain farofa with bacon, it’s one of the best side...

US President Joe Biden said he will try to triple the tariff rate on...

BytePlus, the corporate technology arm of TikTok’s parent company ByteDance, Sui announced a strategic...

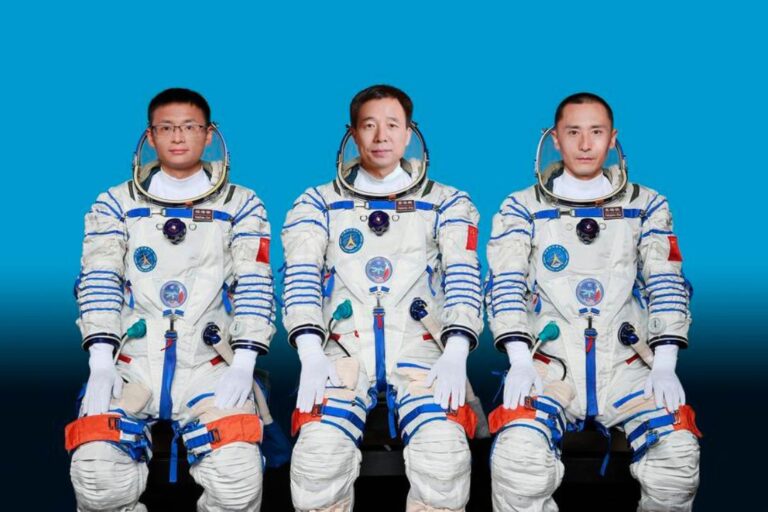

Three astronauts who participated in the Shenzhou-16 manned mission received medals this Thursday for...

The Chinese People’s Liberation Army Navy will hold open day events in many coastal...

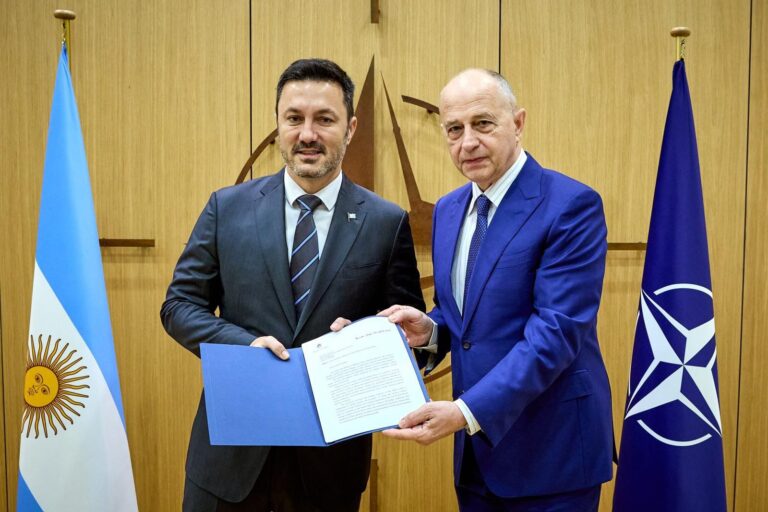

The Minister of Defense of Argentina, Luis Petri, advertisement the country’s interest in becoming...

since the weekend Bitcoin There were sharp declines in altcoins under his leadership. BTC...

To make this fluffy and delicious powdered milk bread you...

Binance exchange continues its steps to return to USDC issued by Circle company. While...

There is now very little time left for the halving update, which will reduce...

Controversial cryptocurrency project founded by OpenAI CEO Sam Altman Worldcoinannounced that it would launch...

Bitfinex, one of the important exchanges in the cryptocurrency world, was also added to...

Gain more health with this apple cider vinegar, water and...

Taiwan’s National Science Council launched the Taiwan Chip-Based Industrial Innovation Program in 2023, which...

After the tension between Iran and Israel that started over the weekend Bitcoin ve...

Andreessen Horowitz (a16z), a company known for its investments in the USA from crypto...

In the heart of the province of Tucumán, the Argentine lemon industry flourishes with...

Disclaimer: This content is a sponsored article. Bitcoinsistemi.com is not responsible for any damages...

We are now days away from Bitcoin’s halving, which occurs every 4 years and...

Books by Chinese President Xi Jinping were topics of discussion at events in Argentina...

Just a few days before the halving, which will halve miners’ rewards in Bitcoin,...

Bitcoin (BTC) ve in altcoins While there have been significant declines since the weekend,...

An earthquake with a magnitude of 6.6 hit the west coast of the Japanese...

This chicken quiche is delicious, learn how to make this...

Taiwan Semiconductor Manufacturing (TSMC), the leading maker of advanced chips used in artificial intelligence...

The Runes protocol, which Casey Rodarmor, the creator of the Ordinals protocol, which attracted...

Just a few days before the halving, one of the most important building blocks...

The ancient Cham towers, Vietnam Cham towers are red brick and sandstone towers found...

Tension between Iran and Israel over the weekend Bitcoin ve in altcoins giant whales...

One of the most talked about areas in the crypto world lately has been...

Leading cryptocurrency exchange OKfor spot trading in his post Parcl’ı (PRCL) He announced that...

China is willing to deepen Belt and Road cooperation with Suriname, Chinese President Xi...

He/she positively affects the market and the price of the relevant altcoin with his/her...

Make this delicious Oat Cake for your afternoon and morning...

Bitcoin, which rose above 66 thousand dollars yesterday with the Bitcoin and Ether spot...

China’s gross domestic product (GDP) grew 5.3% year on year in the first quarter...

BICT expands connections with North Africa and Spain Batumi International Container Terminal (BICT), the...

cryptocurrency is one of the important market makers in the market and attracts attention...

Hong Kong International Airport (HKIA) maintained its position as the world’s busiest cargo airport...

Solana-based “Move to earn” application STEPN collaborated with the world-famous sportswear brand Adidas. The...