A veteran Chinese financial executive is under investigation by authorities, in a further sign of Beijing’s tightening oversight of the country’s struggling securities sector. Zhao Xuejun, chairman of Harvest Fund Management, has resigned from his position at the mutual fund house over the investigation, according to a statement released by the Beijing-based firm. An Guoyong, co-chairman, has taken over as acting chairman.

In the statement, the fourth-largest fund house in mainland China said the board of directors has made adequate arrangements to keep the management, investment and research teams stable, stressing that business operations are proceeding normally. However, the document did not offer details on possible irregularities committed by Zhao or mention the law enforcement authority that has detained him.

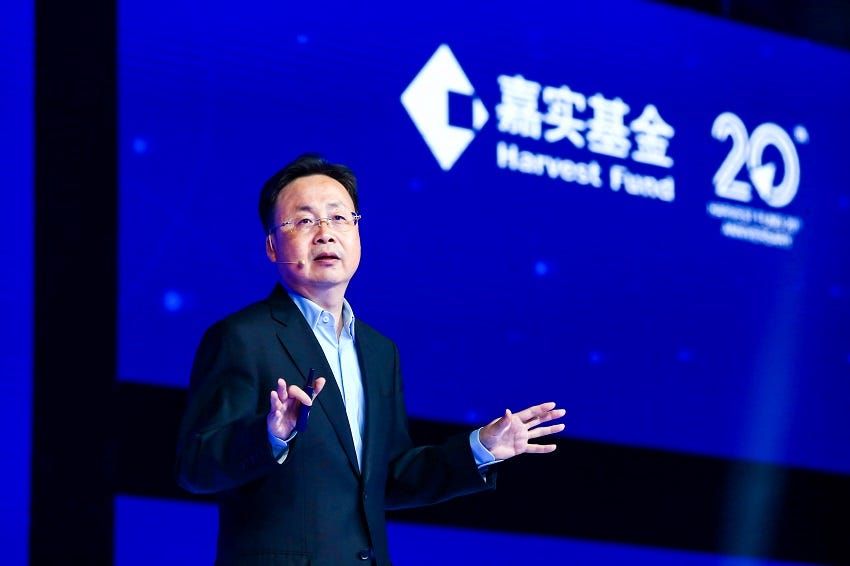

Zhao, 58, who holds a doctorate in economics from Peking University’s Guanghua School of Management, became Harvest’s chairman in 2000 and was named president and CEO in 2017. He is regarded as an open-minded professional with an international perspective on mainland China’s stock market.

Under his leadership, Harvest evolved from a simple mutual fund manager into an asset management conglomerate, whose activities range from real estate and stock investment to smart investment research services. Harvest manages assets worth 1.57 trillion yuan (US$219 billion) and has generated nearly 200 billion yuan in returns for its investors, according to the company’s website.

Zhao’s potential downfall will add to evidence that Beijing is stepping up its crackdown on the securities sector amid a slumping stock market. China’s National Audit Bureau has sent inspection teams to major mutual fund firms with the aim of rooting out illegal behavior by these wealthy institutions. The cleanup campaign is expected to end in September.

Bangladesh: between China, India and Pakistan

Most of the country’s top brokerages and asset management firms are state-owned. The high wages paid by China’s financial services industry do not align with President Xi Jinping’s common prosperity initiative, which emphasizes equitable distribution of wealth at a time when the nation faces economic headwinds.

Shares of mainland-listed companies have been struggling to find a new catalyst as the economy grapples with headwinds from weak consumption and a prolonged downturn in the property market. Demand for stocks has also been waning after a state-intervention-fueled rally lost steam as investors shifted their focus to growth prospects and corporate profits. The CSI 300 Index has fallen nearly 10 percent from a peak in May.

The financial services industry is considered elite in China as it pays high salaries to its employees. This does not align with Xi Jinping’s common prosperity initiative, which emphasizes equitable distribution of wealth at a time when the nation faces economic challenges. Top regulators plan to cap annual salaries for financial workers at around 3 million yuan, as part of a drive to root out extravagance in the industry and narrow the wealth gap.

Source: https://reporteasia.com/negocios/2024/08/09/china-ejecutivo-financiero-endurece-control/