The governor of Japan’s central bank said this Wednesday that he may consider a change in monetary policy, with a new interest rate hike, if the recent devaluation of the yen causes an acceleration in inflation.

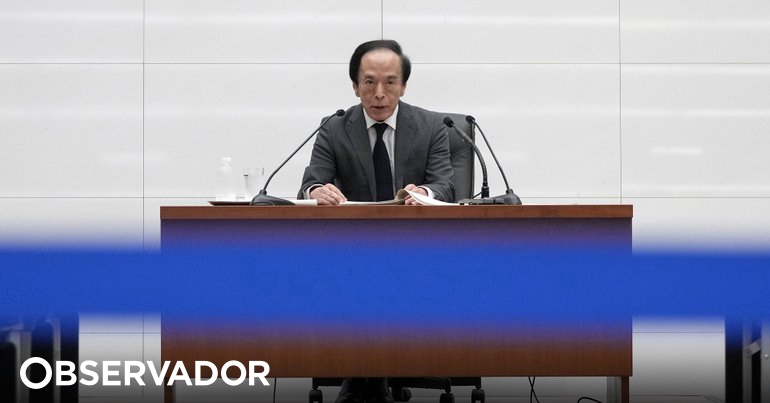

“Compared to past situations, exchange rate fluctuations are more likely to affect prices” for consumers, said Kazuo Ueda, before a committee of the Japanese parliament.

The leader of the Bank of Japan (BoJits acronym in English) added that “it is closely monitoring recent yen depreciation movements”.

Japan’s currency was trading in a range close to 154 yen per dollar this Wednesday, after falling to 160 yen at the end of April, for the first time in 34 years. This after the BoJ have unanimously decided to maintain monetary policy.

US dollar surpasses 160 yen barrier for the first time since 1990

Ueda admitted that it is possible that inflation in Japan is currently more dependent on changes in the foreign exchange market and “more aggressive” movements by companies in setting prices or wages.

“In some cases, this will cause underlying inflation to change. If such a situation were to occur, a monetary policy response would be necessary,” said the governor of BoJ.

Japan’s central bank raised its short-term benchmark interest rate in March to 0.1%, the first increase in 17 years, but still a far cry from rates in other major world economies.

The yen has been depreciating sharply against the dollar, among other currencies, largely due to this differential.

A weak yen tends to boost the stock market, as it inflates exporters’ foreign remittances, but also increases the costs of imports of energy and raw materials, on which Japan is dependent.

Inflation in Japan stood at 2.6% in March and has been two years above the 2% target set by the BoJinitially due to the climb of the cost of energyresulting from the war in Ukraine, and currently due to the increase of the price of food.

Source: https://observador.pt/2024/05/08/banco-central-do-japao-nao-descarta-nova-subida-de-juros-para-travar-inflacao/