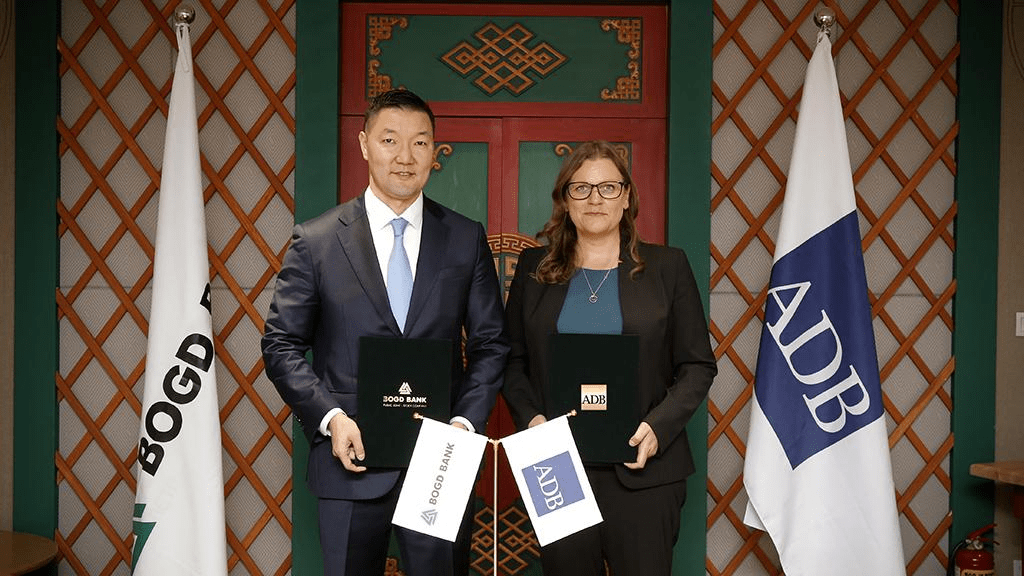

The Asian Development Bank (ADB) and Bogd Bank JSC have signed a $15 million loan to provide financing to micro, small and medium-sized enterprises (MSMEs) in Mongolia, with a focus on women-led MSMEs and green finance.

The financing package comprises $14 million from the ADB, half of which will go to women-led or women-owned MSMEs, and $1 million from the ADB-administered Canadian Climate Facility for the Private Sector in Asia II (CFPS II). The CFPS II concessional loan will be combined with ADB financing to fund climate finance initiatives for MSMEs, including the procurement of energy-efficient equipment and small-scale renewable energy installations.

“Mongolia’s capital market needs further development as financial institutions have limited access to foreign capital. ADB fills this funding gap by providing long-term financing to local lenders, thereby reducing borrowing costs for MSMEs,” said Suzanne Gaboury, Managing Director of Private Sector Operations at ADB. “The rollout of blended and concessional loans will also enable Bogd Bank to offer new green financing products to the underserved MSME segment, stimulating growth and investments in energy-efficient equipment and small-scale renewable energy systems.”

ADB helps Ningbo city become a low-carbon economy

MSMEs play a vital role in Mongolia’s economy, accounting for the largest share of all registered businesses and jobs and contributing 18% to the nation’s gross domestic product. However, access to credit is a major obstacle to their growth, with MSMEs set to account for less than a third of total outstanding bank loans in 2023. Mongolia’s women entrepreneurs face major challenges, as they are less likely to receive loan approvals compared to men, despite accounting for almost half of the workforce and having higher repayment rates.

“Bogd Bank is dedicated to empowering MSMEs, women-led businesses and fostering green initiatives in Mongolia. Partnering with an organization like ADB, which shares our vision of boosting Mongolia’s economy through impact lending, fits perfectly with our mission. We are delighted to embark on this collaboration with ADB and are confident that it marks the beginning of a fruitful long-term partnership,” said Saruul Ganbaatar, CEO of Bogd Bank.

The rollout of blended and concessional loans will also enable Bogd Bank to offer new green financing products to the underserved MSME segment.

Founded in 2014, Bogd Bank has 16 branches across the country, employs 230 people, and has provided financial support to nearly 12,500 borrowers across multiple sectors. Bogd Bank’s lending to MSMEs accounts for more than half of its portfolio, with a growing focus on women-owned businesses in trade, agriculture, and healthcare. In 2021, Bogd Bank became the first bank listed on the Mongolian Stock Exchange.

The ADB is committed to achieving a prosperous, inclusive, resilient and sustainable Asia and the Pacific region, while continuing its efforts to eradicate extreme poverty. Established in 1966, it has 68 members—49 in the region.

Source: https://reporteasia.com/economia/2024/06/29/adb-bogd-bank-asocian-proporcionar-financiacion-ecologica-pyme-propiedad-mujeres-mongolia/