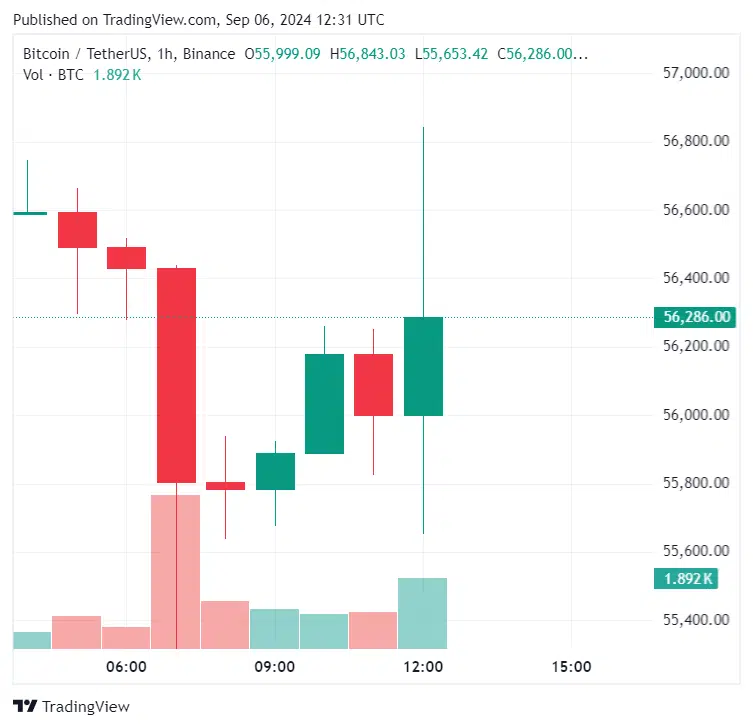

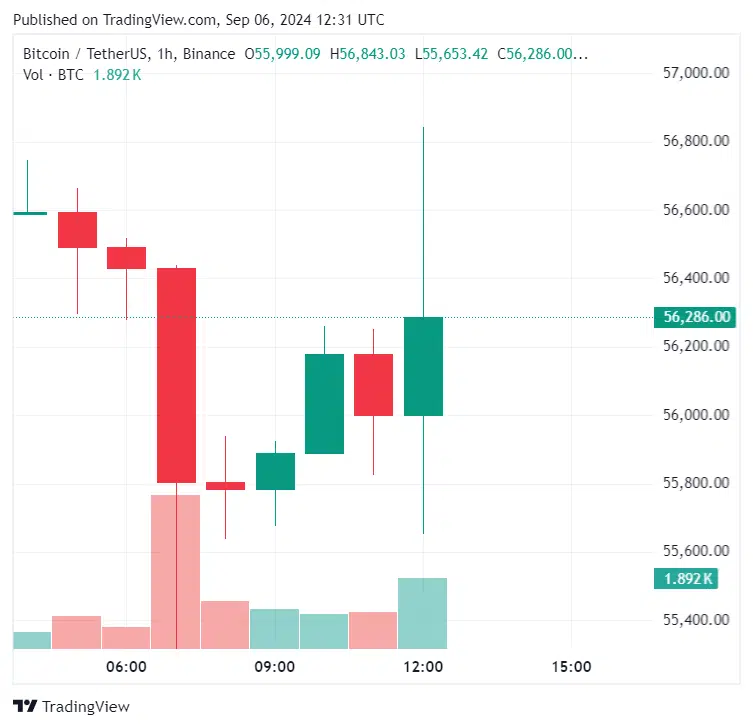

Leading cryptocurrency BitcoinThe downtrend in continuation saw the price drop to $56,000 levels.

Analysts say the downward trend in Bitcoin may continue. BTC Today, all eyes on altcoins are on economic data from the US.

The data announced on the first Friday of each month is closely followed by investors and interested parties to understand the state of the economy.

The data disclosed is as follows:

Nonfarm payrolls data: Announced 142k – Expected 164k – Previous 114k

Unemployment data: Announced 4.2% – Expected 4.2% – Previous 4.3%

Bitcoin’s reaction after the data came was as follows:

The Effect of Non-Farm Employment and Unemployment Data on Prices!

A higher than expected non-farm payrolls data is considered a signal of economic recovery in that country and has a positive impact on the currency.

Changes in the labor market have a significant impact on the FED’s monetary policy. The FED, which believes that the labor market needs to cool down in addition to the decline in inflation, is closely monitoring employment data.

If the announced data comes in above expectations, we may see the DXY (dollar index) rise and Bitcoin pull back a bit. If it comes in below expectations, we may see a pullback in the DXY.

The increase in unemployment rate could cause us to see a sharp pullback in DXY, which would be positive for Bitcoin.

In both cases, volatility will be high in the minutes when the data is released.

*This is not investment advice.

For exclusive news, analysis and on-chain data Telegram our group, Twitter our account and Youtube Follow our channel now! Also Android ve IOS Download our apps and start tracking live prices now!

Source: https://www.bitcoinsistemi.com/son-dakika-abdde-tarim-disi-istihdam-verisi-aciklandi-bitcoinin-btc-ilk-tepkisi-ne-oldu-2/