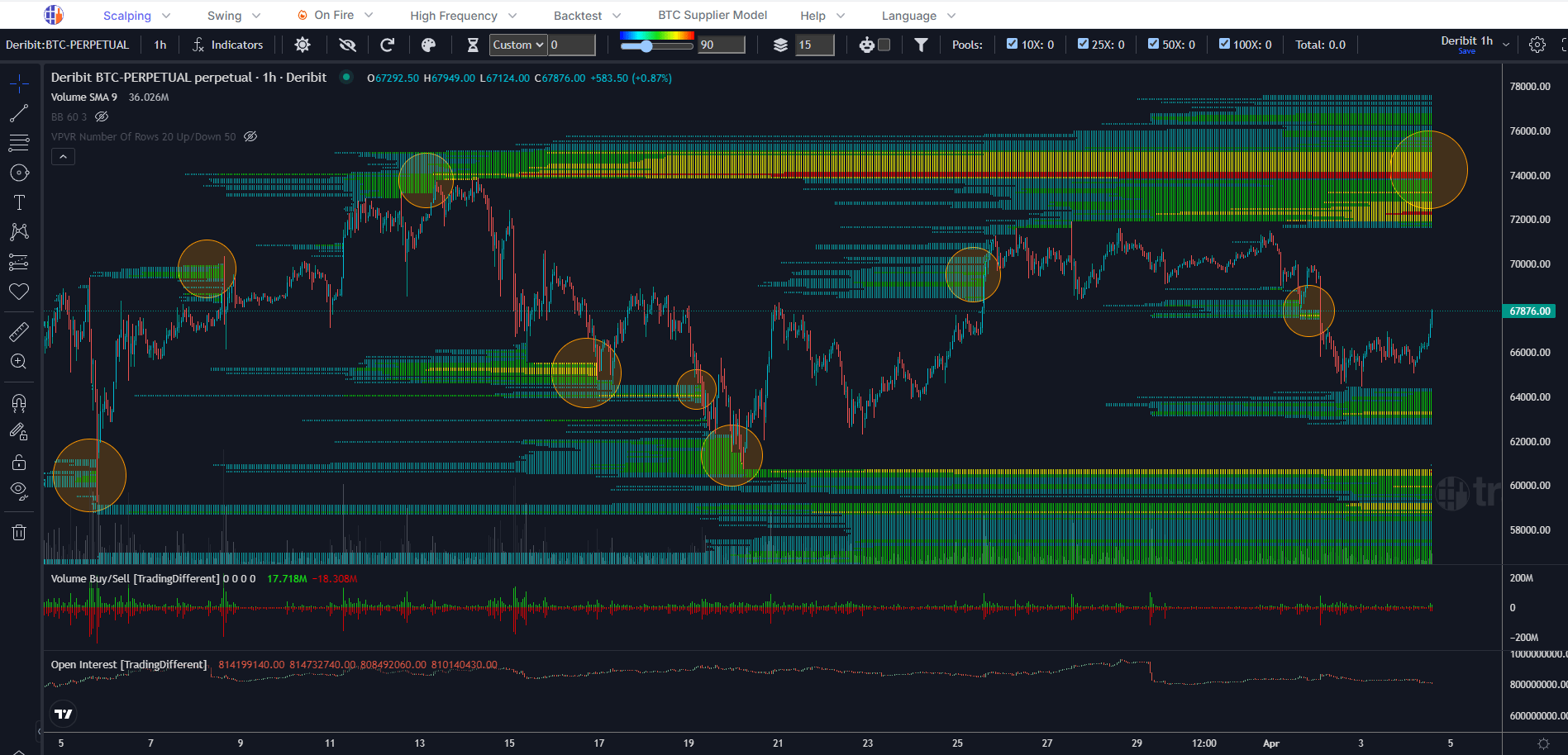

Trading Different CEO Iván Paz has shared a shocking revelation in his latest Twitter thread, where he addresses the hidden dynamics of the Bitcoin market. According to Ivan, 80% of the time, the price of Bitcoin is moved not by humans, but by powerful high-frequency bots operated by what he calls “Strong Hands.”

Iván Paz explains that these bots are designed to detect and exploit liquidity zones, allowing their operators to significantly move the price with few operations and without facing considerable resistance. This manipulation not only affects market perception, but also ends up primarily harming novice traders, who are usually the most affected by these tactics.

You may have heard me say that the crypto market “does not have liquidity.”

80% of the time the price is manipulated to liquidate positions.

I will explain why this happens, what the battle between the bots is like and how this affects your trading.

Open🧵 pic.twitter.com/KhamvAK5LL

— Iván Paz Chain (@IvanPazChain) April 4, 2024

The specialist details that while the market seems to be active 24 hours a day, the reality is that it is these advanced algorithms that are in constant operation, leaving only 20% of the time where the traditional forces of supply and demand take control. The impact of this revelation is significant, offering a new perspective on how investors can approach their trading strategies in such a complex and seemingly manipulated market.

Tools to understand and detect this market manipulation can be found on the Trading Different website. Knowing this allows you to take advantage of the market and improve any trading system.

Journalist and passionate about the Asian world.

Source: https://reporteasia.com/mercados/2024/04/12/ivan-paz-bitcoin